Blog

Artificial Intelligence in Finance Document Workflow: Applications, Examples & Benefits

In an industry where trust is the currency, data inaccuracy can quickly damage a financial professional/institution's credibility. Even a slight oversight in record-keeping could lead to significant financial and compliance risks. With their job role locked in between data management, analysis and high-stakes decision-making, it's like walking a tightrope that requires striking a careful balance.

Considering the due diligence required to scrutinize sensitive data daily for accuracy, traditional document management can't keep up. Financial professionals need an intelligent document management approach that saves time while improving accuracy.

Although many technologies aim to simplify document management, artificial intelligence (the latest disruptor) is making a bigger impact in automating repetitive tasks and enhancing efficiency in ways previously unimaginable. In this article, we will explore how AI is impacting financial document management.

What Is AI-Powered Financial Document Processing?

AI-powered financial document processing implies the use of artificial intelligence to automate data extraction, classification and analysis of financial records. This process goes above and beyond the conventional data entry method, which is time-consuming and error-prone.

With some technologies, such as machine learning, optical character recognition and natural language processing, AI is able to interpret financial documents accurately based on set rules, helping finance experts make sense of big and unstructured data speedily and accurately. With accuracy in check, financial experts can focus on building and nurturing client relationships and make recommendations confidently.

As much as AI is powering document management and proving to be an invaluable investment, it's also important to have a fine line between the human side of the process.

The finance industry holds highly sensitive data, so delegating task automation to AI requires careful analysis. To start with, you need to understand how sensitive your business data is to make the right choice.

Below are some of the financial document categories that can benefit from AI automation:

- Financial statements

- Contracts

- Bank statements

- Tax documents

- Invoices

- Expense reports

- Loan application

- Investment reports

Because of how repetitive these documents are in a financial workflow, they are eligible for AI automation. In the next section, we'll uncover specific use cases of AI for finance documentation and its overall benefits.

AI Applications in Finance: Top 5 Use Cases and Benefits in Document Management

The use cases of AI for documentation in the financial industry are abundant, from data compilation to analysis and forecasting. Let's look at the top five use cases and how some finance companies are reaping the benefits of AI.

Secured E-Signature Workflows

Getting client signatures can become a hassle if the right tool/approach isn't available. It may lead to compromised security, project delays or missed opportunities. For example, clients often have to download unknown software to sign or print out a document to scan and send to their financial partner. For the finance industry, where time and security are critical to decision-making, this approach is faulty, stressful and insecure.

Thanks to technological advancements, getting client e-signatures is more seamless and secure. For instance, Progress ShareFile offers an integrated e-signature solution that helps finance professionals collect signatures easily. This solution allows professionals to organize multiple documents into a file and send them to clients for signature in a few clicks.

Additionally, if a document requires multiple signatures, ShareFile offers a sequenced workflow to request signatures in a set order. It's that easy to use.

Here's what a customer said about ShareFile's e-signature integration:

Source: Customer story

Accurate Finance Document Summarization

A financial manager's typical day often involves strategic planning, financial analysis, meetings and critical decision-making processes. Each activity relies on a tedious routine, which involves reviewing lengthy records.

Take, for example, a financial manager who must file tax documents for different clients. The regular process involves collating income statements, expense reports, payroll data, invoices and receipts. They must also coordinate with other departments to gather relevant documents. Then comes the actual reviewing, which is a huge time suck.

But there's some good news. Financial managers can reclaim time with AI-powered summarization to extract key details and cut off tedious manual analysis.

ShareFile offers an AI-powered workflow that has supported many finance experts in working smartly and strategically. According to finance professionals who have used this feature, "ShareFile gives more time to service clients."

Here's an example:

Faster Document Collection

The goal is to serve clients better and build a strong relationship with them. Unfortunately, documentation often gets in the way for finance experts, leading to daily workflow chaos. Many firms that have seen this gap quickly are leveraging a smart approach. And now, 34% of those who adopted AI-enabled innovative approaches are seeing a significant improvement in their operational efficiencies.

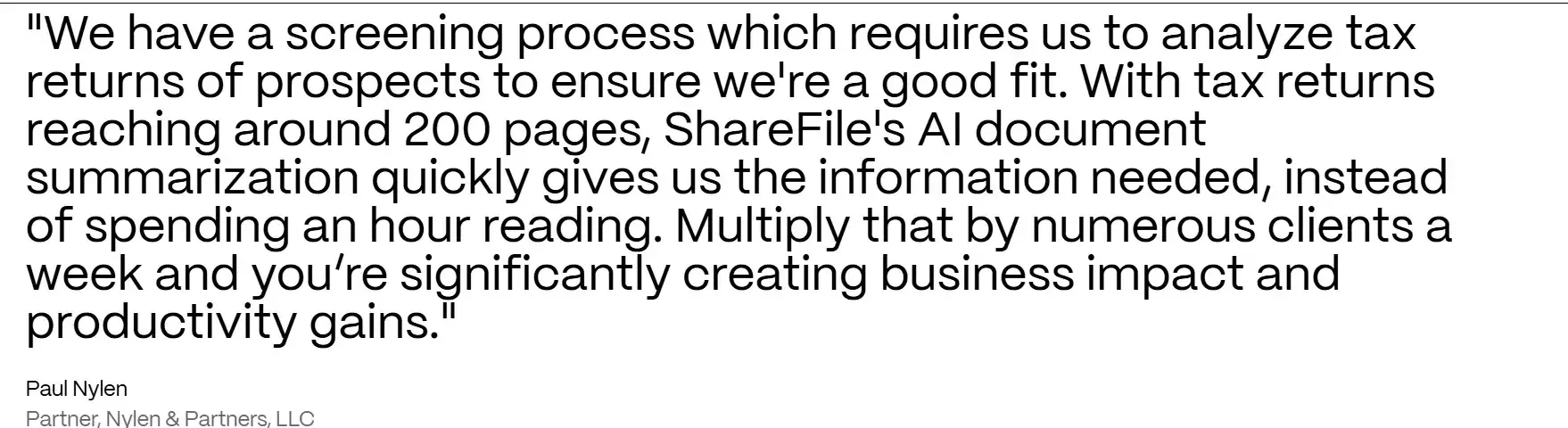

While there are many ways to simplify quick access to document gathering, ShareFile offers a more innovative approach where the AI learns your internal process for a more personalized workflow. With its AI-powered workflow, you can pre-generate document request lists based on your internal process and automate documentation.

If you regularly require new clients during onboarding to share documents like proof of identity, income statements, tax returns and investment records manually, ShareFile can automate this request. Using ShareFile's preset template, you can start a new client documentation request, and the AI will make a secure document request list tailored to the client's financial profile. This sends the client a link to upload the documents on ShareFile. In case of any missed or incorrect documents, an automated follow-up request is sent to the client.

Below is the workflow view:

Finance Document Security Automation

Data security is a critical benchmark in the finance industry. As a result, financial institutions invest in sophisticated tools to secure clients' and companies' details. A common approach is manual document encryption via email or password protection. However, as more strict security measures are needed, this manual approach isn't scalable and leaves room for human error and security breaches.

With the help of AI workflow in document management, finance teams can automate these security needs without compromising compliance. One such use case is with ShareFile's AI-driven workflow. With this feature, you can automate file-sharing security and reduce the possibility of human error caused by manual intervention.

Another benefit of automating document security is its productivity and efficiency boost for employees as they manage hundreds or thousands of documents. Employees can focus on the strategic part of their daily work while ShareFile handles the encryption. All documents are automatically encrypted both in transit and at rest, with no extra steps needed from staff.

ShareFile also offers an advanced document protection solution (Virtual Data Room, or VDR) to encrypt the most complex confidential documents. This provides an extra layer of confidentiality and security to document management.

Two-Way Project Management for Clients and Team Members

Having clients and team conversations over email is professional, but using the same channel to manage projects could be a recipe for disaster and chaos. Consider a consultant working with 20 clients to audit their quarterly financial status. The consultant needs to collaborate with the client's legal team and the internal finance department. This is a typical situation where a centralized platform would be beneficial. Otherwise, document versions may get lost in email chains, feedback may not be traceable and deadlines may slip.

Thanks to document management systems like ShareFile, which offer endless collaboration tools for teams and clients, finance professionals can have more control over how different projects are managed without losing track of client communication. Likewise, with an AI-driven workflow, accessing the right data from these pools of documents becomes easier. You can also manage user access to documents based on role and internal parameters in a few clicks.

See how this two-way project management has helped Jessie Kay's team stay more organized:

How to Implement AI in Finance Document Management

AI for finance document management sounds promising, but realizing its full potential requires extreme caution. First, the banking industry deals with sensitive data that requires the highest level of security and privacy. Second, the needs of various finance companies differ, even if their services are the same. The banking sector's need for AI-powered documentation may vary from that of the insurance industry.

In this section, we will discuss crucial elements to consider when deploying AI-powered workflow for documentation in the finance industry.

Assess Your Financial Document Workflow

While it's great to get inspired by other businesses' AI adoption successes, replicating their exact process instead of tailoring it to your specific needs can be costly. Therefore, identify areas of your document process where AI can add value. You may approach this by reviewing customers' feedback on the current document workflow. Then, together with your team, brainstorm with these questions:

- What problem are we trying to solve?

- Is it customer-centric or internal team-focused?

- Which aspect of those problems can we improve with AI to offer an exceptional customer experience or improve team efficiency?

- Will this impose any compliance risk? If yes, how can it be avoided?

Choose the Right AI Tools

Your analysis in the first step above should inform the type of AI tools you need to integrate into your finance documentation workflow. This is important because different organizations within the finance industry can have varying document workflows. For example, investment banks handling high volumes of structured data might prioritize AI tools for data extraction and classification. In contrast, those dealing with more complex, unstructured data might focus on AI-powered documentation with advanced analytics and NLP tools.

Similarly, finance experts should consider the type of documents handled, the volume of data processed, the need for personalization or compliance, and the scalability of the tool to select a tool that can adapt to your growing needs.

Integrate AI with Existing Systems

Integrating new technologies into an existing one is a common concern for many businesses. This is because of factors such as compatibility issues, business goals alignment, security benchmarks and lack of proper strategies.

Verify that the chosen system is compatible with your ERP solution and accounting software for clean data transfer, which saves time and reduces errors from manual input.

For instance, while ShareFile focuses on supporting finance teams with automated document workflow and secure technologies, it allows you to integrate your favourite applications, such as accounting tools like Xero, QuickBooks or other business management tools. These integrations are designed with best practices for handling financial documents in mind.

Train Your Team for AI Adoption

Recent data revealed a significant disconnect between employees' perception of AI usage and business leaders' expectations. To address this, new AI adopters should prioritize employee education. Set up a training program that aligns employees with the AI role in their workflow and their expected impact.

This approach was key to IKEA's successful integration of AI into its operations. As IKEA stated in a press release, "By investing in AI and employees' education, organizations can ensure employees become innovative by using AI. The objective is to embed a deep understanding of AI across the organization, ensuring that Ikea values are reflected in the way the technology is utilized."

In summary, provide a training program that emphasizes best practices for using AI-powered tools and their application in your finance document workflow effectively.

Monitor and Optimize AI Performance

This is where you evaluate the current documentation processes against the set goals. It is where timeless wisdom becomes practical knowledge. Like the physicist and mathematician William Thomson, Lord Kelvin said: "What is not defined cannot be measured. What is not measured cannot be improved. What is not improved is always degraded."

In the case of AI adoption, for example, if you aim to reduce loan application processing time from 5 days to 24 hours without sacrificing data accuracy, it's time to track the performance against your expectations. Assuming its performance falls below expectations or data accuracy is being sacrificed, you may have to refine data extraction models or adjust workflow automation rules.

AI adoption is not a set-and-forget process. Continuous tracking and refinement unlock its full benefits.

Continue Learning About Tech-Empowering Finance Workflows

Maintaining accurate records isn't just a best practice; it's the foundation for minimizing losses, managing cash flow, improving financial analysis and verifying regulatory compliance. With new technologies transforming finance document workflows, professionals can shift their focus to strategic decision-making while maintaining high data quality and adapting to evolving customer needs.

However, as AI continues to evolve, financial experts must stay ahead by learning new ways to simplify document management. By integrating AI-powered solutions into your finance workflow, you'll not only improve your team's productivity but also improve client experience, making documentation faster, easier and more efficient.

Related Resources