Blog

Financial document management guide

In today's complex financial landscape, chaos lurks in disorganized documents. In fact, employees spend an average of 2 hours per day searching for documents. This results in major productivity slowdowns.

Financial document management helps tackle this challenge. It enhances organization, streamlines workflows, and boosts efficiency, security, and compliance.

In this guide, we unlock the power of a well-organized financial document management system. This article uncovers benefits, best practices, and tips to help you choose the best way to organize financial documents for your business.

What is financial document management?

Financial document management is the process of organizing, storing, securing, and accessing all the financial records of a business. It encompasses everything from invoices and receipts to contracts, tax documents, and bank statements.

How financial documents are managed can be either physical or digital. Physical methods involve storing paper documents in filing cabinets, binders or at off-site storage facilities. Digital methods involve using secure software to house and manage files electronically.

While digital document management excels in space savings and effortless search capabilities, physical storage may be the preferred option for documents that are more sensitive in nature. It's for this reason that 72% of companies choose a hybrid approach. This typically involves the physical storage of highly sensitive documents and the digital storage of most other records and files. Taking a hybrid approach can help improve efficiency and organization while keeping critical documents secure.

Why and how document management is important for a financial institution?

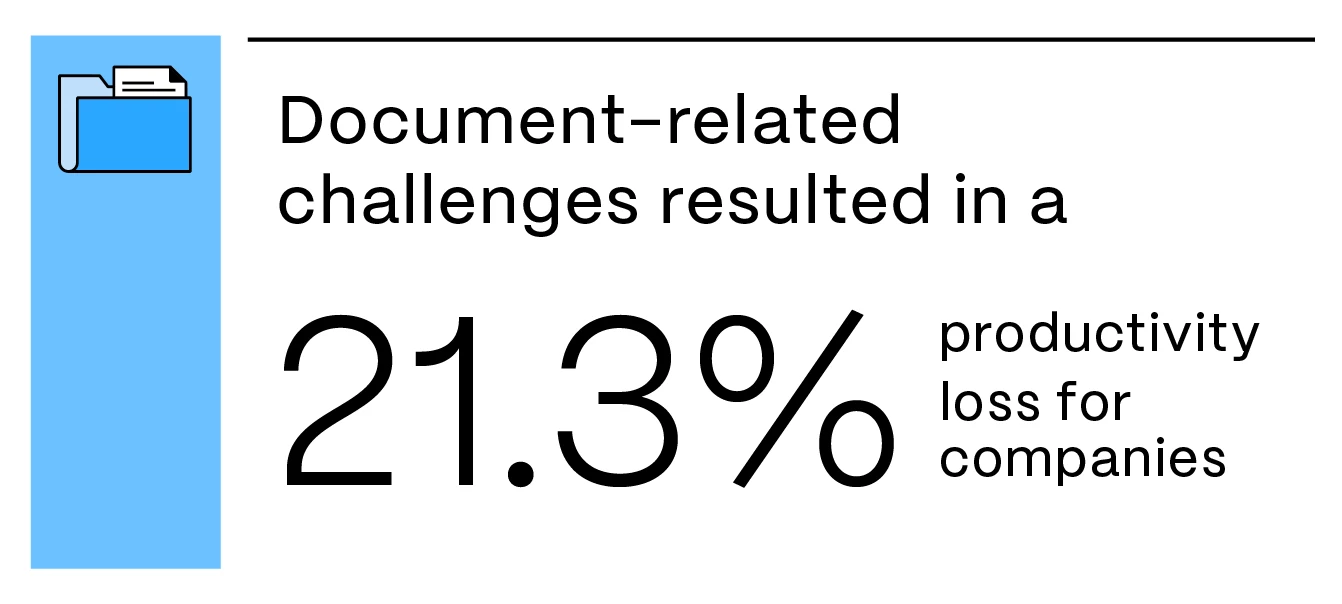

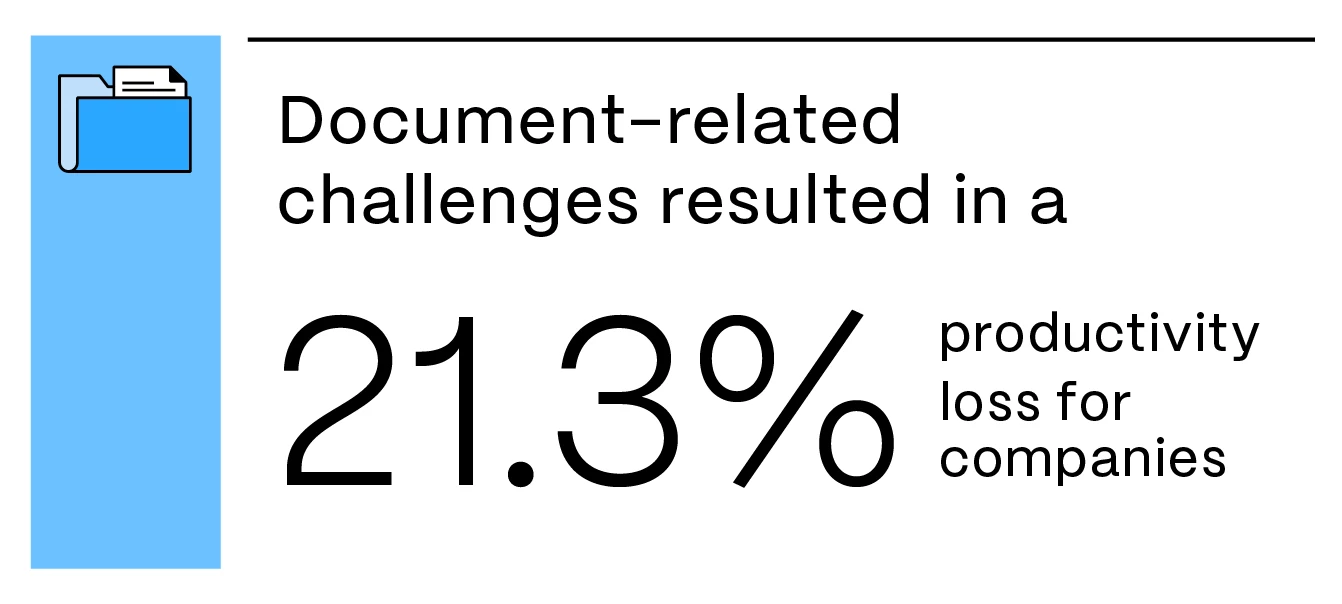

Document-related challenges result in a 21.3% productivity loss for companies. With financial document management, businesses become an efficient machine. Storing, retrieving, and managing any document becomes simple, saving time and resources.

Furthermore, financial document management helps maintain regulatory compliance. This minimizes the risk of hefty fines and legal issues during audits, which in turn, helps keep businesses running smoothly.

Financial document management benefits

We've broken down what financial document management is. Now, let's explore how digitizing the system can supercharge your business.

Enhanced organization

Financial institutions juggle a massive volume of critical financial records. This makes choosing the best way to organize financial documents paramount.

Enter: financial document management software. This powerful solution helps organize financial documents in the most efficient way. Here's how:

- Centralized repository: All documents are housed in a single, secure digital location. This eliminates the need for scattered filing cabinets and the risk of lost paperwork. No more frantic searches – every document is just a few clicks away.

- Flexible categorization: Documents can be categorized and tagged based on various criteria (e.g., customer name, account type, document type or date). This allows for easy retrieval and a customized organization structure that perfectly suits your business needs.

- Metadata magic: Financial document management software leverages the power of metadata. This "data about data" allows for robust search functionalities using keywords, making it easy to find exactly what you need, even if it's buried within a lengthy report.

Improved efficiency and productivity

With financial document management software, documents are housed in a central digital location where they are meticulously categorized and searchable by keywords. This means faster processing times, improved customer service, and a more productive workforce.

But document management goes beyond simple storage. Automation also plays a key role in streamlining processes. Document automation for finance can be used for repetitive tasks like data entry or report generation, giving valuable time back to employees for more strategic work. to be automated. These are critical benefits as a Xerox study found 46% of employees waste time on inefficient paper processes every day.

By combining robust organization with automation, financial institutions can significantly streamline how documents are handled. Not only does this save time, it minimizes errors, and allows employees to focus on what matters most – customers.

Better compliance and security

Financial institutions walk a tightrope. They must balance efficiency with the ironclad security and compliance demanded by financial regulations. A single data breach or regulatory misstep can be catastrophic.

A robust financial document management system offers:

- Built-in compliance: By keeping everything stored, organized, and accessible at all times, your business can maintain compliance and be well prepared for audits — not to mention avoid costly financial penalties.

- Security for sensitive data: Financial information is a prime target for cybercriminals. Document management systems offer strong security by encrypting documents and restricting access to authorized personnel. Detailed logs track document changes and user activity, enabling swift action if suspicious activity occurs.

Efficient document management prioritizes compliance and security. This helps foster customer trust, reduce fines, and ensure confident navigation of all regulations.

Best practices for financial document management

Your financial organization relies on accurate records for smooth operations. Let’s explore some best practices to ensure documents are organized, secure, and readily accessible.

1. Organize your financial records

Conquer the clutter with effective categorization and labeling.

Whether using a digital filing system or a physical filing cabinet, here are some tips to get you started organizing:

With software

- Make it customer-centric: Organize documents by customer. This allows for quick access to all documents related to a specific client.

- Categorize by document type: Create categories for different document types, such as loan applications, account statements, investment records, and legal documents.

- Use a date hierarchy: Nest subcategories within document types by date. For example, within "Loan Applications," you could have subcategories for "2023", "2024", and so on.

- Implement customizable tags: Many systems allow for adding custom tags to further refine document organization. Use tags like "delinquent", "high risk", or "closed account" for easy filtering.

Without software

- Clearly label folders: Use clear and concise folder labels such as, "Customer Accounts," "Loan Applications," or "Investment Records."

- Color code your documents: Assign colors to different document types for quick visual identification.

- Standardize naming conventions: Develop a consistent naming system for files, like "ClientName_AccountType_Year_DocumentType.pdf"

- Organize subfolders by date: Within folders, create subfolders by year to manage large volumes efficiently.

2. Consider document management solutions

Today, technology is a game-changer for financial document management.

Digital systems offer:

- A central repository: Document management solutions provide a secure, central location to store all your financial documents. This makes everything accessible from any authorized device.

- Powerful security: Documents should be encrypted at rest and in transit, with granular control over who can access what. Audit trails track document changes and user activity, ensuring a clear picture of document history.

- Automated capture and indexing: No more manual data entry. Scanning software can automatically capture documents and extract key information for indexing. This makes files instantly searchable.

- Advanced search and categorization: Powerful search and customizable categories allow you to locate specific documents by keywords, dates, and even by content within the document itself.

- Version control: Document management systems keep track of all document versions. This ensures you're always working with the latest iteration.

- Workflow automation: Streamline repetitive tasks. Digital document management systems can automate workflows for tasks like document approvals, routing documents for review, and sending reminders.

- Robust integrations: Eliminate data duplication and streamline workflows by using a system that seamlessly integrates with your existing financial software (e.g., accounting or loan processing systems).

3. Take steps to implement an effective system

Now that you've chosen your financial document management software, here comes the crucial part: implementation.

Consider these tips to ensure a smooth transition and full user adoption:

- Make a plan: First, define your document management goals (e.g., faster retrieval, improved compliance, etc.). Next, craft a detailed implementation plan with tasks, timelines, and resource allocation (including data migration strategies for existing documents).

- Empower your teams: Invest in comprehensive training for your staff on the new system or revised procedures. Interactive sessions with hands-on practice are key for user comfort and proficiency.

- Foster a culture of use: Keep your team informed throughout the process. Actively solicit user feedback to improve the system and ensure it aligns with staff needs. Consider offering incentives for early adopters to encourage widespread system use.

4. Overcome common challenges

Even the most robust financial document management solution can falter if implementation isn't handled strategically.

Let’s dig into common challenges and practical solutions to ensure a smooth rollout:

Challenge 1: Resistance to change

- Solution: Embrace transparency. Clearly communicate the benefits of the new system, emphasizing how it will save time, improve accuracy, and streamline workflows.

- Tip: Involve key stakeholders in the planning process. When employees feel heard and have a say in the system's setup, they're more likely to embrace it.

Challenge 2: Data migration issues

- Solution: Develop a clear data migration strategy. Consider factors like data volume, file formats, and retention requirements. Partner with the document management system vendor or a data migration specialist if needed.

- Tip: Start with a pilot migration of a small subset of data to identify and address any potential issues before migrating everything.

Challenge 3: Integration woes

- Solution: Ensure the document management system integrates seamlessly with your existing software solutions to eliminate data duplication and streamline workflows.

- Tip: During vendor selection, prioritize systems with open APIs (application programming interfaces) that facilitate smooth integration with your existing software landscape.

Related Read:Document Management Best Practices (2024)

Find the best way to organize financial documents for your business

Financial document management is key to business success, helping boost efficiency, minimize errors, and maintain compliance. By integrating purpose-built software into your document management strategy, these benefits become magnified thanks to features like secure storage, advanced search, and robust security.

Remember, a successful implementation hinges on more than just technology. A stalled financial document management system can become a well-oiled engine through careful planning, user training, and a culture of adoption. This engine will fuel efficiency, empower your staff, and propel your financial institution toward a future of success.

Related Resources