Blog

Financial document automation guide to supercharge workflows

The volume of documents financial organizations must manage can be overwhelming, especially when handled manually. Financial document automation eliminates manual processes by putting document management tasks on autopilot — freeing up time, streamlining workflows, and reducing errors.

This financial document automation guide will explain what it is, how to use it, and how it can benefit your business.

Document automation for finance: your questions, answered

The financial sector thrives on precision and efficiency, where even a single misplaced decimal or extra zero can cause a domino effect of errors. This is where automation becomes crucial.

Automation, the use of technology to take over tasks traditionally done by humans, encompasses both simple actions like scheduling emails and complex processes like building financial reports.

Next, we’ll explore what financial document automation is and how it can transform operations by answering commonly asked questions.

What is financial document automation?

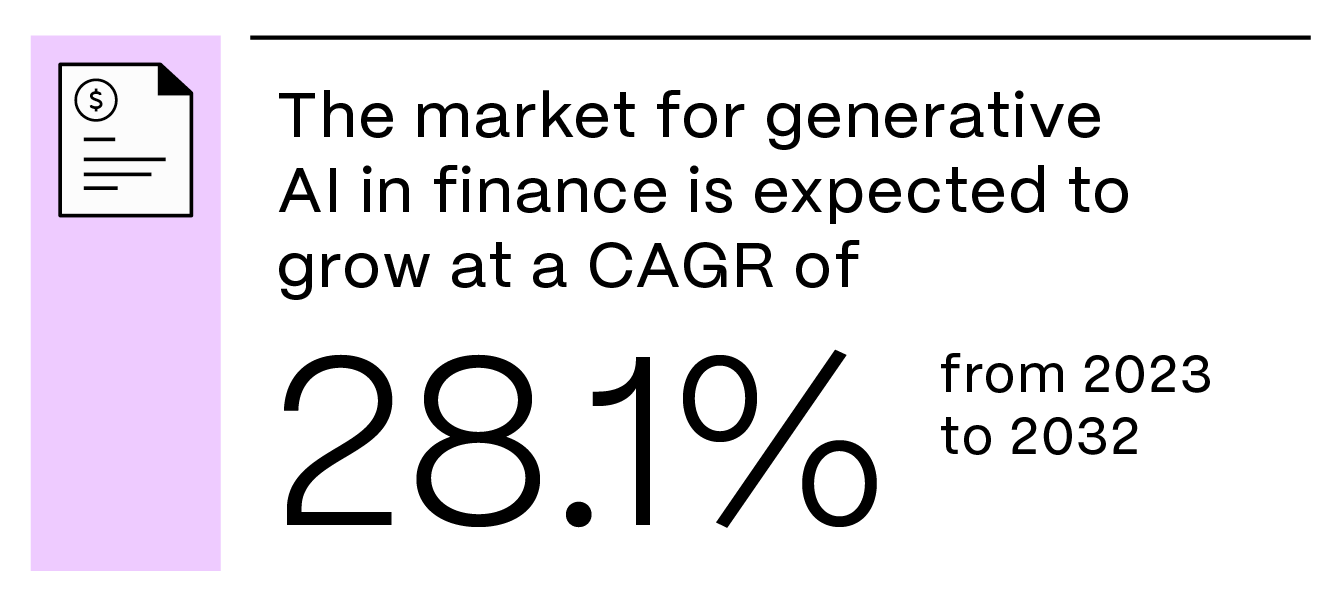

Financial document automation leverages technology to streamline the creation, management, and distribution of financial documents such as contracts, reports, and invoices. This process is powered by artificial intelligence (AI), with the market for generative AI in finance expected to grow at a compound annual rate of 28.1% from 2023 to 2032.

In financial automation, AI tools like optical character recognition (OCR) extract text from scanned documents, while natural language processing (NLP) helps understand the context and meaning of that text. This allows the system to categorize information, populate templates, and even make basic decisions based on predefined rules, enabling increased efficiency, minimizing errors, and enhancing regulatory compliance — all with minimal human intervention.

But automation isn't just for managing documents — it’s a workflow game-changer across the entire financial landscape, streamlining processes and driving significant improvements in productivity and accuracy.

What is financial process automation?

Financial process automation goes beyond document automation by using technology to automate entire workflows. This technology streamlines the entire invoice cycle by eliminating the need for manual data entry, approval chasing, and individual payment initiation.

For example, financial process automation gathers information and data from various sources to populate the invoice template for you. Once ready, it routes the invoices to the appropriate people for sign offs. And it can even schedule payments automatically once the invoice is approved.

What is financial reporting automation?

Financial reporting automation acts like a virtual accountant, handling the entire process of creating and delivering essential financial reports.

Gone are the days of spending countless hours gathering data from various systems, formatting reports, and ensuring regulatory compliance. With financial reporting automation, data is swiftly collected, analyzed, and transformed into polished, compliant reports without any manual intervention. This automation streamlines reporting tasks, allowing your team to concentrate on the more engaging and strategic activity of analyzing data to make informed financial decisions for the company and its clients.

How does financial document automation work?

Imagine having hundreds of customers and needing to manually create invoices for each one every month. It would be a tedious, error-prone process, involving endless copy/pasting and consuming a significant amount of time.

Which is where the power of financial document automation comes in. Here's how it works:

- Template creation: Automation creates a pre-built invoice template with fields for customer information, product details, and pricing, effectively creating a fill-in-the-blank form.

- Automatic data integration: The software connects with your company's accounting system to automatically pull in the necessary data for each invoice, eliminating the need for manual copy/pasting.

- OCR integration: For past sales orders containing customer and product information, automation uses OCR powered by AI to extract data directly into the invoice template.

- Automated calculations: Automation uses predefined formulas to calculate totals and taxes automatically.

- Automated routing and delivery: Once an invoice is ready, automation routes it to the appropriate person for final approval and sends it to the client for payment.

Which banking or financial document processes can be automated?

Financial document automation encompasses a wide range of tools designed to manage paperwork across various areas of the financial sector. Here’s a look at the processes that can be automated:

- Invoice generation and payment collection: Automation generates invoices, sends statements, and collects payments from customers, ensuring timely and accurate transactions.

- Payroll management: Payroll automation handles calculations, generates pay stubs, and processes direct deposits, simplifying payroll management.

- Vendor payments: Accounts payable (AP) automation streamlines the processing of supplier invoices, accelerates approvals, and automates payments, maintaining positive vendor relationships.

- Purchase order management: Automation facilitates the creation and approval of purchase orders, manages quotes, and tracks deliveries, ensuring efficient and accurate purchasing.

- Client management: Automation helps generate account opening documents, collect onboarding agreements, and facilitate document request lists, expediting the onboarding experience.

- Financial reporting: Automation gathers data, performs calculations, formats reports, and distributes them, allowing the finance team to focus on analyzing data and making informed business decisions.

Automation can also serve as your assistant for other financial tasks too, like expense management, loan applications, and even bank reconciliations.

Related Read: What is AP (accounts payable) automation?

Can you automate financial statements?

Yes, you can automate a significant portion of financial statement creation. Automation tools can gather data, perform calculations, format statements, and distribute electronically.

Financial document automation benefits

Now that we’ve covered the ins-and-outs of document automation for finance, let’s explore the benefits.

Increase efficiency

Financial document automation significantly reduces the time and effort spent on tedious tasks such as:

- Manual data entry: Automation eliminates the need for manual data entry by automatically importing and processing data from various sources, enhancing accuracy and efficiency.

- Document formatting: Automation ensures that documents are consistently formatted to look neat and professional, eliminating the frustration of manually having to fix formatting issues.

- Document assembly: Automation assembles documents from multiple sources, saving time and ensuring that all necessary information is included in a cohesive format.

Reduce errors

Manual data entry often leads to errors such as misplaced decimal points and missing numbers, causing significant issues in financial documents. These mistakes not only create inconsistencies but also waste valuable company time and resources.

Automating data processing minimizes these risks by ensuring that financial information is always accurate and consistent. Automation tools enhance data integrity and improve the overall efficiency in financial operations.

Improve compliance and simply audits

Navigating financial regulations can be complex and time-consuming. Financial document automation simplifies this process by providing tools to maintain compliance and enhance auditability.

- Streamlined compliance: Automation tools streamline the compliance process, continuously monitoring and checking for adherence to regulations. This function acts like an automatic spell check, but instead of typos, it helps maintain compliance with financial regulations.

- Regulatory assurance: These tools help meet all necessary regulatory requirements, ensuring that no critical compliance steps are missed.

- Comprehensive audit trails: Automation provides clear audit trails, documenting every step of the financial process. This detailed record makes it easier to address any auditor queries and ensures transparency.

Significant cost reductions

Financial document automation not only saves time, it also reduces costs significantly.

- Reduced overhead costs: By reducing reliance on physical documents and storage, automation decreases costs associated with renting and maintaining office space.

- Lower supply expenses: Automation minimizes the need for expensive office supplies like printer ink and paper, reducing operational expenses.

- Minimize costly errors: By minimizing human errors, automation prevents costly mistakes in financial documents, saving the expense of correcting these errors later.

Enhance customer service

Financial document automation enhances customer service by making processes faster and more accurate.

- Help customers faster: Automation streamlines internal processes, resulting in faster turnaround times for customer services.

- Enhance accuracy: Automation minimizes errors, ensuring customers receive accurate information and services, thereby increasing trust and satisfaction.

- Prioritize customer care: By increasing overall efficiency, automation allows you to focus more on providing personalized and attentive service, making customers feel valued.

Supercharge workflows with document automation software

Financial document automation is a game-changer for businesses in today's fast-paced financial world. It increases efficiency, reduces errors, saves time and money, and improves compliance. Automation also allows teams to focus on more strategic initiatives and helps maintain positive relationships with vendors and customers.

Remember, the key to unlocking these benefits lies in finding the right financial document automation solution for your specific needs. With the right software in place, your financial organization can experience a significant transformation.

Related Resources