Simplify Tax Prep from Start to Finish

Streamline your client engagements with a turnkey solution that unifies everything from client intake to signing the 8879.

Watch How ShareFile Saves You up to 4.25 Hours per Client Engagement

The Income Tax Return Solution Streamlines Individual and Business Tax Prep in One Place.

Watch VideoAccelerate Engagements

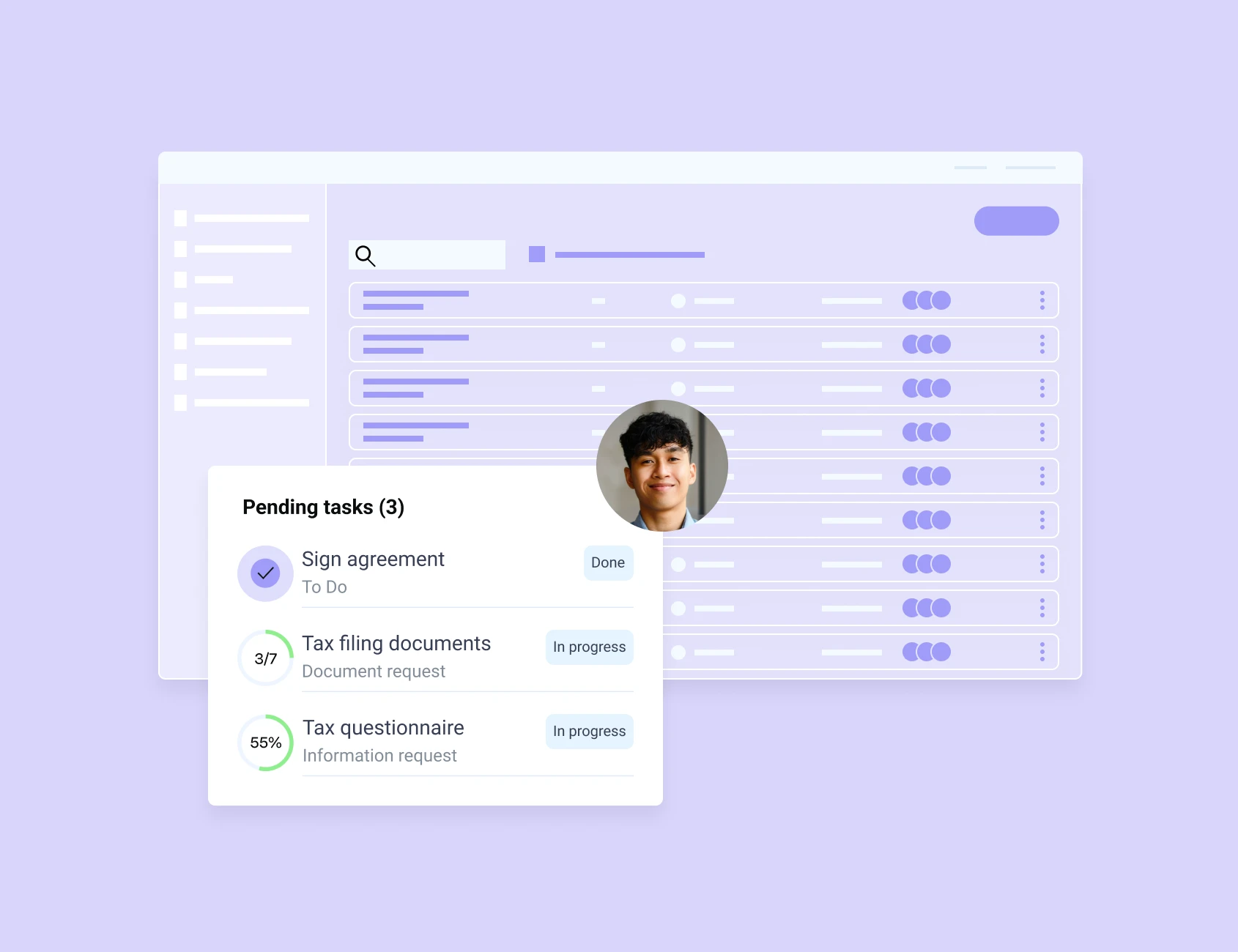

Eliminate time-consuming manual tasks in tax engagements like emailing, document collection, and sending agreements. With built-in automation, the solution streamlines the client onboarding process—so you can focus on higher-value work or bring on more clients with ease.

Launch client engagements in bulk—whether it's one or one hundred. A centralized dashboard gives your team full visibility into every engagement, helping you stay organized and efficient at every step.

Consolidate and Conquer

Tax Prep

Reduce the need for multiple tools to manage client tax engagements. Manage document requests, digital forms and e-signatures in a single, streamlined solution—reducing both costs and tech stack complexity..

Speed Up Client Interactions

No more tool-hopping—clients can complete their tax engagement in one place. With an intuitive client portal, they'll always know what's needed and when.

Automated notifications and comments capability boost clarity, speeding up client responses by up to 32%!

Features That Replace Chaos With Control

Templates for Individual & Business Tax Prep

Turnkey templates for individual and business tax preparation — forms 1040, 1065, 1120-S, 1120-C, and 990. Need something custom? Everything is customizable!

Effortless Client Onboarding

Bulk onboard and collect client information with time saving automations and intake forms.

Automate Engagement Letters

Send automated engagement letters with embedded e-signature to speed up the engagement process.

Collect Client Data with Templated Questionnaires and PBC Lists

Enable seamless collection of client documents and data with customizable, templated request lists and digital forms.

Improve Staff Visibility

and CollaborationDelegate tasks, collaborate with team members and manage client engagements in a single location.

Import Files Easily from Popular Accounting Software

Securely and easily transfer files between ShareFile and accounting software like CCH, Drake, Lacerte, ProSeries, UltraTax and others.

Streamline the Finalization Process

Finalize the service by sending IRS form 8879s for e-signature with knowledge-based authentication, centralizing the entire process in the client engagement.

FAQs

-

How does ShareFile software simplify income tax return preparation?

ShareFile software simplifies income tax return preparation by streamlining onboarding, simplifying document collection, providing seamless communication with clients and managing the approval process. With prebuilt templates, automated reminders and real-time tracking, firms can reduce back-and-forth and eliminate manual handoffs—especially during peak season.

As part of a modern tax workflow management software solution, Progress ShareFile helps manage multiple tax engagements in parallel. It also complements your existing systems by organizing client files and request lists, so data is ready when you need it.

-

Can I onboard multiple tax clients at once with ShareFile software?

Yes, the ShareFile product make it easy to onboard multiple tax clients at once. You can send document request lists in bulk, set deadlines and monitor status across all clients from a centralized dashboard.

Built to support high-volume engagement cycles, ShareFile software helps reduce the manual work required during onboarding. Instead of chasing emails or tracking files manually, you can automate the intake process and keep your focus on preparation and review using your preferred tax return software.

-

What documents can I collect using the ShareFile product to input into my tax preparation software?

With ShareFile software, you can collect W-2s, 1099s, K-1s, prior-year returns, expense reports, bank statements and various supporting documents that may be needed to complete your client's tax return.

Designed to work alongside leading IT return software, the ShareFile product allows you to create custom request lists, automate reminders and receive documents in a secure, organized format. This helps you acquire accurate information ready for entry into your preferred tax platform.

-

Does ShareFile software support IRS Form 8879 e-signatures with KBA?

Yes, ShareFile software supports electronic signatures for IRS Form 8879 using knowledge-based authentication (KBA). This lets your clients complete signature steps remotely with added identity verification, aiding in compliance and reducing turnaround time.

When used with your income tax return software, the ShareFile product helps close the gap between document delivery and approval—facilitating a secure and client-friendly experience.

-

What’s the benefit of using an income tax return solution with my tax return software?

Using ShareFile products alongside your tax return software helps reduce inefficiencies and manual delays. Instead of toggling between email, spreadsheets and folders, your team can automate document collection, e-signatures and client communication in one place.

ShareFile software adds a secure, scalable layer to your filing process, supporting better organization and faster turnaround without disrupting your existing software stack. It pairs especially well with income tax return software to create a more streamlined workflow from intake through filing.

-

Is this suitable for mid-sized firms using tax return software for CPAs?

Absolutely. ShareFile software makes a strong fit for mid-sized firms that rely on tax return software for CPA workflows. It offers flexible document management, task automation and e-signature tools that help your team handle large client volumes more efficiently.

Whether you're managing individual or business returns, ShareFile products support the operational structure firms need to stay productive and responsive throughout tax season.